One of the alleged administrators of the cryptocurrency exchange Garantex has been detained in India. He was arrested while vacationing with his family at the request of the United States. Currently, Beshchekov is being held in Delhi, awaiting extradition to America. Russian law enforcement agencies were also involved in the investigation of Garantex’s activities.

The arrest was also reported by cybersecurity expert Brian Krebs, a former journalist for The Washington Post, in his blog.

U.S. authorities accuse Beshchekov of conspiracy to launder money, violating sanctions, and operating an unlicensed financial enterprise. According to the U.S. Department of Justice, since 2019, Beshchekov has managed the cryptocurrency exchange alongside Alexander Mira Cerda. Garantex, headquartered in Moscow, is reported to have facilitated transactions totaling at least $96 billion, a significant portion of which, according to investigators, is linked to illicit operations.

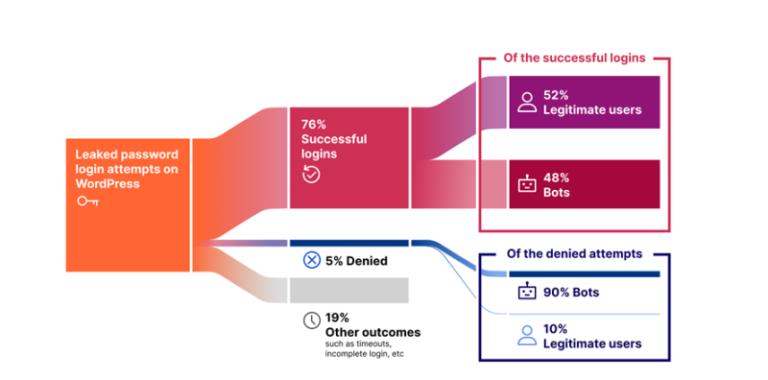

In early March, intelligence agencies from the United States, Germany, and Finland conducted a coordinated operation to dismantle Garantex’s infrastructure. They seized servers and databases and obtained copies of the company’s financial records. U.S. authorities assert that the exchange was used for laundering criminal proceeds associated with drug trafficking, cyberattacks, and terrorism financing. Additionally, the cryptocurrency firm Tether, under pressure from American regulators, froze over $26 million in USDT stablecoins linked to Garantex.

Garantex has denied the allegations, maintaining that the exchange operates within the bounds of the law and fully complies with Russian regulatory requirements. A company representative emphasized to RBC that Russian law enforcement has no claims against the exchange, as Garantex adheres to all anti-money laundering (AML), counter-terrorism financing (CTF), and non-proliferation of weapons of mass destruction (NPWMD) regulations. The representative further noted that the exchange actively assists in criminal investigations.

“In all criminal cases affecting Russian citizens, as well as those referred through Interpol or other channels by law enforcement agencies from third countries, Garantex has taken all necessary measures in full compliance with legal requirements,” the exchange’s spokesperson told RBC Crypto. “These actions include blocking accounts associated with illicit transactions, refunding funds by court order, and facilitating investigative and forensic procedures.”

Garantex believes that the situation is politically motivated and not rooted in actual criminal activity. The company’s representative stressed that the exchange has repeatedly cooperated with international law enforcement in tracking down criminals and has helped return assets to affected users through its compliance mechanisms.

However, court documents suggest that Garantex’s management deliberately concealed illicit transactions through complex money transfer schemes and misled law enforcement. Notably, when Russian intelligence services requested information about an account registered to Mira Cerda, the exchange allegedly provided false information, claiming that the account had not been verified.

In 2022, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) imposed sanctions on Garantex, accusing it of facilitating money laundering linked to ransomware operations and darknet markets. In February 2025, the European Union followed suit, adding Garantex to its latest sanctions package.