Credit: James O’Brien/OCCRP

An international investigation involving 32 media organizations has uncovered an extensive network of fraudulent call centers, luring thousands of victims into nonexistent investment schemes. The inquiry was based on a massive 1.9 TB data leak, provided to Swedish Television by a whistleblower, along with the coordinated efforts of journalists from OCCRP.

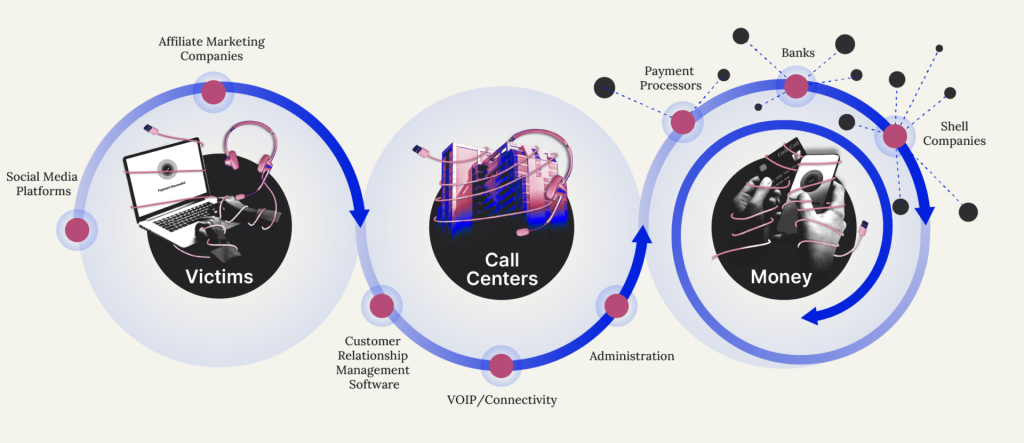

Over the past four years, these criminal enterprises defrauded more than 32,000 victims, siphoning off hundreds of millions of dollars. The primary tool for attracting new targets was a deluge of deceptive advertisements on social media, crafted by marketing firms. According to the investigation, TrafficON, Supreme Media, and ROI Collective played a pivotal role in the operation, despite previously denying any involvement in such fraudulent activities. Testimonies from victims now irrefutably confirm their participation in the scheme.

One of the largest of these fraudulent networks was the so-called “Sapphire Network.” The organization operated offices across Israel, Cyprus, Ukraine, and Bulgaria. Between 2021 and 2024, it managed to amass $247 million from 27,000 victims across 30 countries.

Investigators highlighted a Georgian call center owned by A.K. Group, which alone—with just 85 employees in its Tbilisi office—raked in $35 million from 6,000 victims.

The core recruitment mechanism relied on targeted social media advertisements, including on Meta platforms*, promoting allegedly lucrative trading investments. Upon registering, potential victims were quickly transferred to call centers, where highly trained “sales agents” manipulated them into making financial commitments. To incentivize success, fraudsters were rewarded with Rolex watches, luxury vacations, and other lavish perks.

The connection between call centers and their victims was maintained through five major VoIP providers, which processed payments via cryptocurrency or bank transfers using shell companies.

To track financial flows, interactions with victims, and agent performance, the operation utilized internal CRM systems. A particularly critical component was the Predator system, an exclusive tool accessible only to the organization’s top-tier operators, which maintained detailed records of profits and victims’ personal data.

The illicit proceeds were laundered through intricate financial maneuvers, involving hundreds of front companies registered across Europe. These shell corporations enabled the circumvention of anti-money laundering (AML) regulations, effectively obscuring the true origin of the funds.

The investigation into the operational mechanics of this vast fraud network remains ongoing. Experts plan to release three additional reports, focusing on:

- The strategies used to identify and recruit victims

- The techniques employed to extract funds

- The intricate methods of laundering illicit gains